Contents

It also provides companies with securities with the option of obtaining cash without reducing their liquidity. Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP.

The Capital Market is a market for financial investments that are direct or indirect claims to capital. It is wider than the securities market and embraces all forms of lending and borrowing, whether or not evidenced by the creation of a negotiable financial instrument. The capital market comprises the complex of institutions and mechanisms through which intermediate term funds and long term funds are pooled and made available to business, government and individuals. The capital market also encompasses the process by which securities already outstanding are transferred. Think of an auction house where buyers and sellers negotiate prices and make trades.

Do you know what Callable Bonds and Puttable Bonds are?

Fund-seekers include companies, entrepreneurs, governments, etc. For example, to fund the economy and development projects, the government issues bonds and deposits. Investors invest money intending to make capital gains as their investments grow over time.

What is an example of a capital market?

Capital markets are financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets. Capital markets include the stock market and the bond market.

At least 25% of the equity shares must be owned by the public. It is the largest market and is also known as the new issues market or IPO market and is concerned in issuing new securities to buyers. Many small and medium companies enter this market to elevate money from the public for their firms. A capital market provides support of capitalism to the country with a wave of economic reforms. Investors need a broking account and a demat account to invest in ETFs.

Are you aware of the Debt Mutual Funds?

However, the secondary market deals with securities already in existence. Unlike stocks, mutual funds, and bonds, private equity funds usually invest in more illiquid assets. By purchasing companies, the firms gain access to those https://1investing.in/ assets and revenue sources of the company, which can lead to very high returns on investments. The disclosure, transparency, accountability and investor protection are important for growth and development of capital market.

; stock exchanges and a network of dealers who facilitate ‘Over-The-Counter’ sales are all part of this secondary market. In simple terms, an Equity Capital Market or ECM is where financial institutions meet prospective companies looking to raise funds. Since every company has different requirements, ECMs are divided into specialised niches.

Are you aware of the Equity Mutual Funds?

Such bonds have a call option in the bond contract, which lets the issuer alter the tenor of the security. For example, a 10-year bond may be issued with call options at the end of the 5th year such as in the SBI bond illustration below. Such options give issuers more flexibility in managing their debt capital.

The firm on the other hand, is affected by the debt-equity ratio permissible, SEBI Regulations on issue of capital, and the formalities to be complied with while raising an issue. This is a series of explainers to educate and inform new investors. In association with Dun & Bradstreet India as knowledge partner. A Company Secretary plays a very important role in the capital market and its related compliances. However, the money that you invest in equity securities isnotrequired to be paid back by the business.

FAQ 1. What is the difference between Money Market & Securities Market?

Upon submission of the preliminary inspection report by NSE to SEBI, the regulator issued an ex-parte ad-interim order dated 22-Nov-2019 issuing directives in investor interest. The nature of this order is such that by definition, it is an ‘interim’ directive and not a final finding. The order itself states emphatically, that this is in response to preliminary findings and is subject to further review upon a more comprehensive audit and investigation.

Examples ofasset allocation fundinclude life stage funds that invest across asset classes suitable to the age of the investor. Such funds will have a higher allocation to equity in the initial years and reduce equity exposure and increase debt exposure as the age advances. Callable bonds allow the issuer to redeem the bonds prior to their original maturity date.

The existence of deep and broad capital market is absolutely crucial in spurring the growth our country. An essential imperative for India has been to develop its capital market to provide alternative sources of funding for companies and in doing so, achieve more effective mobilisation of investors’ savings. Capital market also provides a valuable source of external finance. Financial markets consist of a broad range of venues where people and organizations exchange assets, securities, and contracts with one another.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.” Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant.

The regulatory bodies are responsible for monitoring and eliminating any illegal activities in the capital market. Securities and Exchange Commission, for example, oversees stock exchange operations. Underwriters act as intermediaries in the issuance of bonds.

How does the Capital Market benefit You?

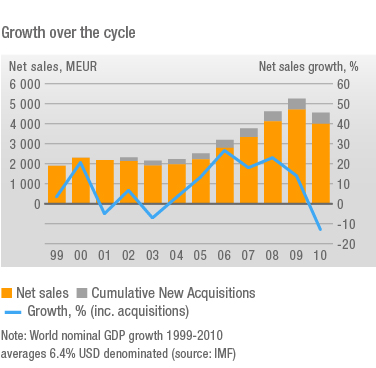

In addition to enhancing productivity growth and providing greater employment opportunities, strong capital markets also enhance macroeconomic stability, as well as providing a wide range of other tangible and intangible value-adds.

On the other hand, the secondary market is for trading in existing securities. There are no fresh issues in the dealings of the secondary market. So, when the company sells its shares to any financial institution like banks, insurance companies and so on it helps in raising funds quickly, economically, and efficiently. Such a company neither sells nor offers the securities largely to the public. A primary market is the most important type of capital market.

An equity market is a place where shares of a company are traded. It is popularly known as the stock market or share market. After globalisation of the Small Scale Industries Indian economy in 1991, many foreign institutional investors (FII’s) from across the world started to invest in India through the securities markets.

Emerging Markets and Developing Economies are highly exposed, and capital markets are one of the main transmission channels of this on-going, global, systemic shock. The private sector is highly exposed to the current crisis, especially small- and medium-sized firms. Know-how about intraday trading – Before you jump into the stock market bandwagon by listening to random tips, it would be better to know how to do intraday trading for better results with your trades and investments.

They also receive dividends, interest, and ownership rights. Investors use the secondary market to obtain cash, either to invest in another stock or for personal consumption. It involves liquidating assets so that other things can be purchased. Unlike stocks, bonds are typically held for a longer period – usually until they expire.

- A capital market aims to improve transaction efficiency by bringing together suppliers and investors and facilitating their share exchange.

- The equities that are traded in an equity market are either over the counter or at stock exchanges.

- For equity investors, the drama of the past year has played out in four distinct acts, reflecting marked shifts in expectations about the pandemic’s duration and its impact on consumers and businesses.

- The primary function of the securities markets is to enable to flow of capital from those that have it to those that need it.

The author has done a Bachelors in Banking and Insurance . Her goal is to help readers make better investment decisions. In the next chapter we will explore more about money markets. Earlier disclosure requirement for persons holding more than 5% shares or voting rights or in the case of any further change in their shareholding or voting rights has been done away with.

Leave a reply